Before following this tip, please check with your financial advisor, CPA, or tax preparer. Keep in mind everyone’s financial situation is unique.

Face it, US tax regulations compel us to be packrats, cluttering our homes and offices. Whether paper or digital, we’re required to retain stacks of personal tax-related documents for typically 7 years. That’s an unreasonably long time. Business tax document retention rules differ. If you prefer paper documents, those piles get big quickly unless you have an EZ lifestyle.

How do I manage the taxation paper pile burden? The flip of the annual calendar triggers shredding. I grab the oldest file folder, aka “the seven years ago file”. I scan through it to ensure nothing was misfiled or contains info I feel more comfortable holding on to for a bit longer such as support documents related to a tax dispute.

My little workhorse rapidly makes mincemeat of those old tax docs.

Then the shredding begins. It only takes a few minutes, as there is only one year to annihilate, and I own a high-speed, multi-page micro-shredder. The process will go even faster in future years as more docs continue to arrive digitally in lieu of paper copies.

This quick task creates space for the beginning of a new tax year. Old folders are repurposed. As new documents flow in, I have a designated place to store them. Less thinking, more rapid organizing action.

A few days ago, when I shredded the contents of that old folder, it was the last of solely personal tax-related support docs. From here on out, I will need to devise a system for old business-related invoices and receipts until I’m confident it is time to ditch them. It’s hard for me to believe The Practical Sort has been around this long.

Here’s what IRS.gov has to say about record retention. Again, check with your financial advisor or tax preparer for your situation.

Period of Limitations that apply to income tax returns

The period of limitations is the period of time in which you can amend your tax return to claim a credit or refund, or the IRS can assess additional tax. The information below reflects the periods of limitations that apply to income tax returns. Unless otherwise stated, the years refer to the period after the return was filed. Returns filed before the due date are treated as filed on the due date.

Keep records for 3 years if situations (4), (5), and (6) below do not apply to you.

Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return.

Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction.

Keep records for 6 years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return.

Keep records indefinitely if you do not file a return.

Keep records indefinitely if you file a fraudulent return.

Keep employment tax records for at least 4 years after the date that the tax becomes due or is paid, whichever is later.

I hope this info helps to guide you toward more efficient and less bulky tax stack.

If you’ve been with me for a while, you’ll likely recall the tip below. If you’re a recent subscriber, than this strategy might be just what you need. Either way, I think it’s a valuable reminder for us all as we wrap our heads around another tax season.

Are your paper and digital 1099s, W-2s, et al beginning to stream in? Wonder how one organizer keeps it all straight for fast, efficient tax filing? One secret is, and I rarely advocate plastic, but these 14 pocket file folders I purchase at Office Depot are simply ideal for so many paper organizing purposes. I use them for client files, business invoices, medical and estate paperwork files, and for taxes. Each year I clear out a previous year tax file and begin anew. The tabs (which I had previously created) are already inserted and follow the IRS tax schedule such as W-2 income, charity, interest, dividends, etc.

The folders keep the documents orderly, neat, and easy to locate when I’m working on a tax schedule category.

Keep your tax docs on your computer too? Set up your e-folders to mirror your physical folders for quick info. retrieval.

Tax filing is complicated, but you will love the ease of this tax prep system. So will your CPA if you use one. Just grab the folder and you're on your way.

No More Late Fees

It’s one thing if your bills are not paid prior to the due date if you don’t have the funds. It’s another if you are paying late fees because you missed the deadline. The latter is a little easier to solve than insolvency with a few tweaks.

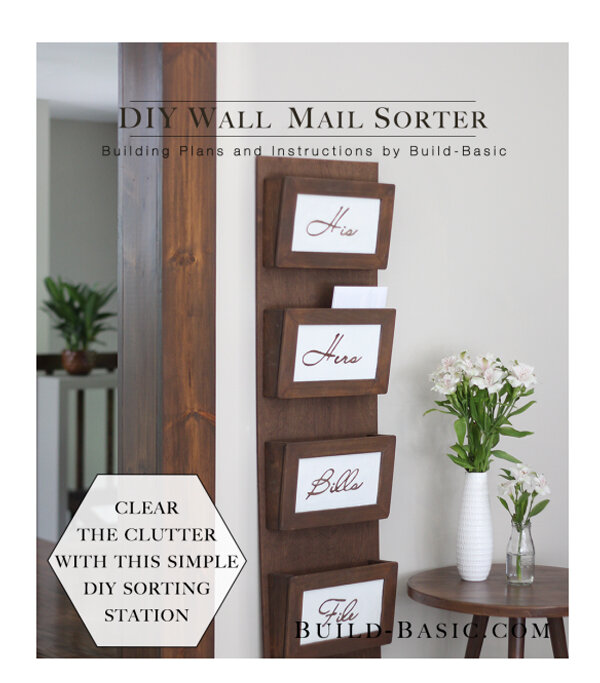

Photo reprinted from Build-Basic.com. If you’re a DIY’er, they have numerous cool step-by-step projects to help you declutter. Caution: don’t get diverted from your main tasks with shiny thing syndrome.

1. The case for paper bills. If you are a visual person, as much as I don’t wish to encourage paper waste, you might need paper bills as a reminder. I recommend that if you have available wall space, use a vertical wall filing system to keep the bills visible until they are paid. File them away or dispose (whatever suits your comfort level) after the payment has been dispensed.

2. Ditch the envelopes. Remove paper bills from their envelopes and look at the amount due. There are 2 psychological reasons here. Keeping bills neatly tucked in their envelopes leaves you with less of an impetus to deal with them. Secondly, by noting the amount, you will need to budget for what you owe lessening the temptation to overspend during the month.

Most envelopes are recyclable, so toss them immediately into the recycling bin to reduce clutter.

4. Change bill due dates to align with income flow. Some credit cards, loans, and utilities will allow you to adjust your billing date. Contact the Customer Service Department to request a due date change that will align more readily with your paycheck deposits. This may or may not be feasible, but it’s worth a try. Having one date each month to tackle all of your bills could save you time, or if your bank account will not accommodate a big hit all at once, stagger to twice a month.

5. Electronic alerts. Set electronic alerts and financial program notifications to remind you to pay the bills as an extra precaution. Select a date and time that you typically have availability to spend a few moments to pay and record the debits.